PROVIDENCE – Rhode Islanders have less than a week to file their state and federal income tax forms, which must by postmarked or e-filed by midnight on Tuesday, April 17.

To aid taxpayers, the R.I. Division of Taxation issued a special edition of its newsletter and posted a list of the top five errors on returns in the 2012 filing season.

“The R.I. Division of Taxation typically issues 98.5 percent of all personal income tax refunds within 30 days after the returns are received,” said a release. “Still, that always leaves some taxpayers who have not received their refunds. Often, refunds are delayed because of errors involving the returns themselves.”

The top five reasons refunds are delayed included math problems, forgotten signatures, missing forms, misused forms and problems with dual-state returns.

Tax returns with these mistakes must be set aside for manual review. “That delays processing – and refunds,” said Tax Administrator David M. Sullivan.

So far this tax season, more than 85 percent of all returns have been e-filed. That number is roughly 7 percent higher than last year.

Taxpayers who live in Massachusetts but work in Rhode Island could be entitled to tax refunds from 2008 to 2010, according to the Mass. Deptartment of Revenue’s announcement of Directive 12-1.

Massachusetts residents working in the Ocean State paid into the Rhode Island Temporary Disability Insurance Act as part of their income tax.

Directive 12-1 allows Bay State residents to claim TDI payments as part of income taxes paid to another state, resulting in a greater Massachusetts Out-of-State Tax Credit.

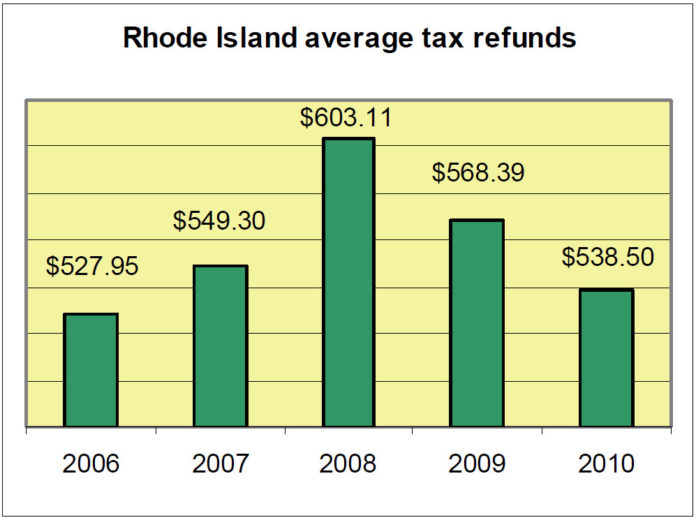

Massachusetts taxpayers can claim the additional TDI taxes on this year’s out-of-state return and amend previous returns from 2008, 2009 and 2010.

“Amending previous returns to claim credit for mandatory TDI contributions from 2008-2011 could result in quite a substantial refund,” says Jackie Pearlman, analyst for H&R Block’s The Tax Institute. “But to claim TDI taxes paid in 2008, taxpayers must act fast and file an amended return before April 17th of this year.”

“Held for review” for 3 months – a simple tax refund. Still no reply from the department. Just more excuses. Last year it was the “flood” This year it’s the “volume.” If they can’t get the job done…Lots of people in this state are looking. So tired of making excuses to my creditors for a refund I was due 90+days ago.