PROVIDENCE – The Providence-Warwick-Fall River metropolitan area is one of the worst in the nation for homeowners, thanks to high maintenance expenses, minimal home price appreciation and expensive energy costs, Bankrate.com said Wednesday.

There are some bright spots for the Providence metro, however: The metro has few foreclosures and home prices are relatively affordable.

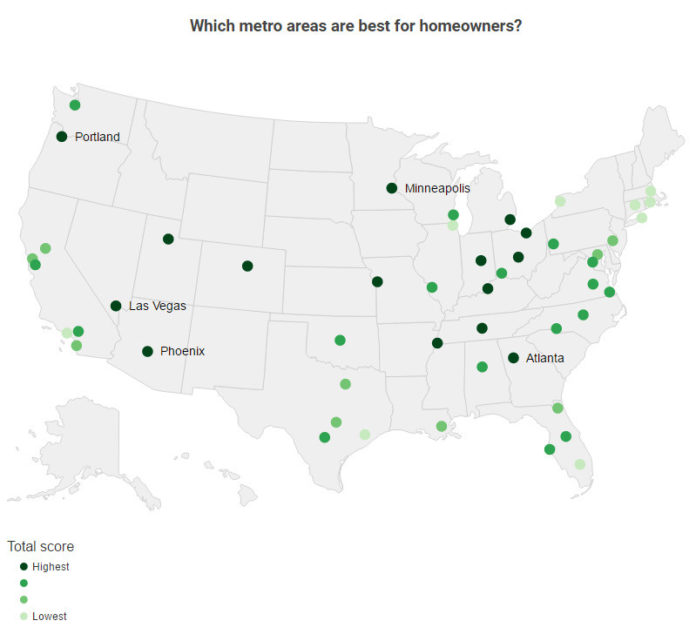

Bankate, a consumer financial services company, released its list of the 50 best and worst metro areas for homeowners, saying that Portland, Ore; Phoenix; Atlanta; Las Vegas; and Minneapolis-St. Paul, Minn.; are the best metropolitan areas for homeowners.

Portland topped the list due to inexpensive homeowners’ insurance, few foreclosures and low energy costs. Strong home-price appreciation catapulted Phoenix, Atlanta and Las Vegas into the top five, while the Twin Cities’ strong home-price appreciation and dearth of foreclosures landed that metro the fifth spot.

The worst metro area for homeowners is Hartford, due to above-average property taxes, and high energy costs, homeowners’ insurance and maintenance fees. The New York City metro area is second-worst due to high property taxes, minimal home-price appreciation and expensive maintenance costs. Los Angeles was fourth worst, and Buffalo, N.Y., fifth worst.

“Major cities in the middle of the country did really well in this ranking,” Bankrate.com analyst Claes Bell, said in a statement. “Out of the top 15 metro areas, only one is within 250 miles of an ocean. Homeowners in America’s largest coastal cities face a number of challenges, ranging from sky-high mortgage payments gobbling up an outsized portion of homeowners’ incomes to high property insurance rates, especially in hurricane-prone areas, and our ranking reflects that.”

Bankrate.com said it looked at factors including property taxes, affordability, property insurance costs, foreclosure rates, maintenance costs, average monthly home energy costs, rent hedging and appreciation rate to come up with the list.