PROVIDENCE – Rhode Island’s foreclosure inventory rate was 1.8 percent in January, higher than 1.6 percent reported a year ago, CoreLogic said Tuesday.

The Ocean State’s rate also was higher than the national rate, which was 1.2 percent in January, a 21 percent year-over-year decline, CoreLogic said. The foreclosure inventory represents the number of homes at some stage of the foreclosure process.

“In January, the national foreclosure rate was 1.2 percent, down to one-third the peak from exactly five years earlier in January 2011, a remarkable improvement,” Frank Nothaft, chief economist for CoreLogic, said in a statement.

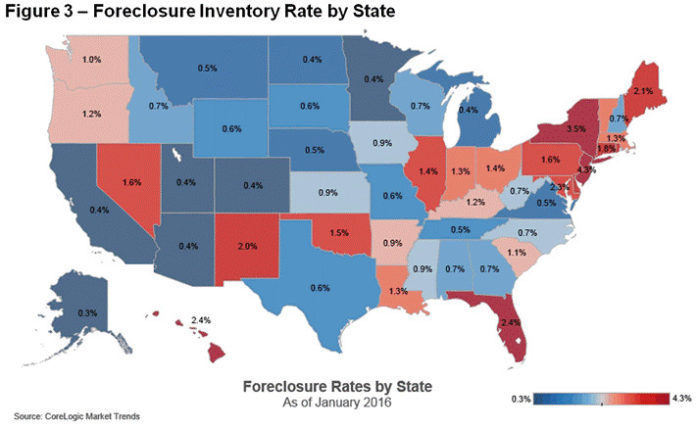

Four states and the District of Columbia had the highest foreclosure inventory rates in January: New Jersey (4.3 percent), New York (3.5 percent), Hawaii (2.4 percent), Florida (2.3 percent) and the District of Columbia (2.3 percent).

Five states with the lowest foreclosure inventory rate in January were Alaska (0.3 percent), Minnesota (0.4 percent), Colorado (0.4 percent), Arizona (0.4 percent) and Utah (0.4 percent).

For the 12 months that ended in January, the Ocean State had 1,243 completed foreclosures, a 24.7 percent drop from the prior-year period, when 1,650 completed foreclosures were recorded. Completed foreclosures reflect the total number of homes lost to foreclosure. Florida had the highest number of completed foreclosures during that period with 74,000, followed by Michigan at 49,000, while the District of Columbia and North Dakota had the least, at 97 and 298, respectively.

Since the financial crisis began in September 2008, there have been approximately 6.1 million completed foreclosures across the country, and since homeownership rates peaked in the second quarter of 2004, there have been approximately 8.2 million homes lost to foreclosure, CoreLogic said.

The serious delinquency rate, mortgages that are 90 days or more past due, fell to 4.5 percent in Rhode Island in January, a 20.9 percent year-over-year change. The national serious delinquency rate, at 3.2 percent, was lower than Rhode Island’s rate.