PROVIDENCE – Single-family home prices in the Providence-Fall River-New Bedford metro area rose 0.6 percent from January 2012 to January 2013, according to CoreLogic’s Home Price Index.

On a month-over-month basis, home prices, including distressed sales, dropped 1.6 percent in January 2013 from December 2012.

Excluding distressed sales, the Corelogic index showed that January home prices in the metro area saw a 2.2 percent year-over-year increase. On a month-over-month basis, home sales, excluding distressed sales, rose by 0.9 percent from December 2012 to January2013.

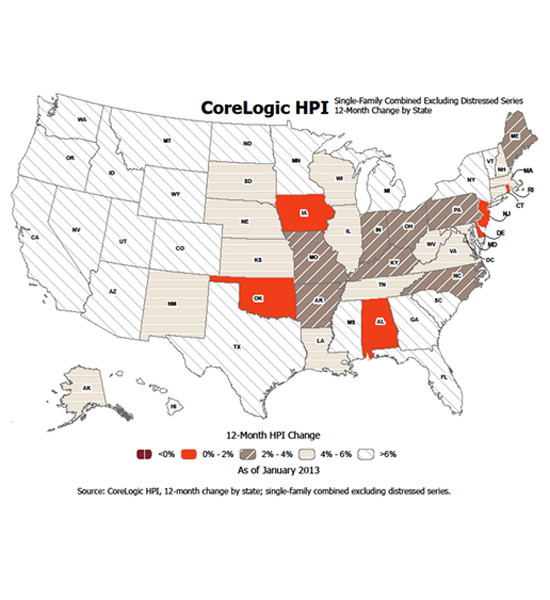

Rhode Island’s single-family home prices, including foreclosures and short sales, increased 0.1 percent year-over-year in January. Excluding distressed sales, the Ocean State’s home prices rose by 1.6 percent from January 2012 to January 2013.

Statewide, Massachusetts saw prices, including distressed sales, rise 5 percent from January of 2012 for single-family homes. Excluding distressed sales, single-family home prices in the Bay State rose 5.3 percent.

Nationally, home prices, including distressed sales, rose 9.7 percent year over year in January. Excluding distressed sales, national home prices rose 9 percent year over year in January.

“The HPI showed strong growth during the typically slow winter season,” Mark Fleming, chief economist for CoreLogic, said in a statement. “With these gains, the housing market is poised to enter the spring selling season on sound footing. The improvements are materializing across the country, with all but Delaware and Illinois showing increasing HPI and 15 states within 10 percent of their peak values.”

CoreLogic President and CEO Anand Nallathambi said that the improvement seen in states across the western U.S. and along the East Coast were “likely to boost home sale activity into the first half of 2013.”

Including distressed sales, only four states reported over-the-year price declines in January: Illinois (-0.4 percent) and Delaware (-0.1 percent). Excluding distressed sales, no states posted home price depreciation in January.

CoreLogic listed Rhode Island as one of the five states with the largest “peak-to-current declines,” including distressed sales. Rhode Island’s home prices are 35.5 percent lower than they were at the state’s peak price. The other four states were: Nevada (-51.6 percent), Florida (-43 percent), Arizona (-38.9 percent) and Michigan (-37.4 percent).