WASHINGTON – Residential real estate prices dropped more than forecast in the year ended October, showing a broad-based decline that indicates the U.S. housing market continues to be weighed down by foreclosures.

The S&P/Case-Shiller index of property values in 20 cities dropped 3.4 percent from October 2010 after decreasing 3.5 percent in the year ended September, the New York-based group said Tuesday. The median forecast of 27 economists in a Bloomberg News survey projected a 3.2 percent decrease.

The real-estate market is bracing for another wave of foreclosures that may keep pressure on home prices, indicating any housing recovery will take time to develop. Nonetheless, rising builder confidence, a pickup in construction and fewer unsold new properties for sale are among signs the industry that triggered the last recession is steadying.

“It’s a picture of a market that’s trying to get back to equilibrium,” Karl Case, co-creator of the index, said Tuesday in an interview on Bloomberg Radio. “Different things are happening in different markets. It’s very segmented. You’ve got these huge inventories that we’ve never really had before.”

Stock-index futures held earlier losses after the report. The contract on the Standard & Poor’s 500 Index maturing in March fell 0.3 percent to 1,256.7 at 9:27 a.m. in New York.

Survey Results

Estimates in the Bloomberg survey for the price change ranged from declines of 2.4 percent to 3.6 percent. The Case-Shiller index is based on a three-month average, which means the October data were influenced by transactions in August and September.

Home prices adjusted for seasonal variations fell 0.6 percent in October from the prior month after dropping 0.7 percent in September. Unadjusted prices decreased 1.2 percent from September as 19 of 20 cities showed declines. Eleven of the cities slumped by 1 percent or more. Only Phoenix posted a gain.

Atlanta and Las Vegas posted new post-peak lows in October, the report showed.

“Atlanta and the Midwest are regions that really stand out in terms of recent relative weakness,” David Blitzer, chairman of the S&P index committee, said in a statement. “These markets were some of the strongest during the spring/summer buying season.”

The year-over-year gauge provides better indications of trends in prices, according to the S&P/Case-Shiller group. The panel includes Case and Robert Shiller, the economists who created the index.

Broad-Based Drop

Eighteen of the 20 cities in the index showed a year-over-year decline, led by a 12 percent drop in Atlanta.

Detroit showed the biggest year-over-year increase, with prices rising 2.5 percent in the 12 months to October. Property values in Washington were up 1.3 percent.

The overall decline in prices is hurting earnings at some homebuilders. Los Angeles-based KB Home, which targets first-time buyers, last week reported a decline in quarterly profit and gross margins weaker than the company forecast earlier.

At the same time, the company said net orders increased 38 percent in the fourth quarter from the same three months last year.

Policy makers are pushing programs aimed at reviving the U.S. housing market. The Obama administration this month started a new version of the federal Home Affordable Refinance Program, or HARP, after the original plan helped less than a quarter of the people targeted to lock in lower mortgage rates.

Federal Reserve officials reiterated at a meeting this month that they will keep their benchmark interest rate near zero until at least mid-2013. The central bank in September decided to reinvest maturing housing debt into new mortgage- backed securities instead of Treasuries.

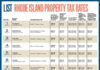

Since this wire story doesn’t mention Providence or Boston, It would have been helpful for PBN to either provide a link to the S&P/Case-Schiller index, like this one:

http://www.standardandpoors.com/indices/sp-case-shiller-home-price-indices/en/us/?indexId=spusa-cashpidff–p-us—-

and/or provide a local addendum that cites the most recent data available for PBN’s area of service. This article from earlier this month would have sufficed:

http://www.pbn.com/RI-home-prices-tumble-7,63028

C’mon folks. It wouldn’t take much effort to make PBN substantially better.

Thank you Michael, very helpful.