PROVIDENCE – Residential foreclosure deed filings dropped 52 percent in the third quarter compared with the third quarter of 2014, according to a report from HousingWorks RI released Monday.

A total of 184 residential foreclosure deeds were filed in the third quarter, compared with 382 in the year-ago period.

“It is encouraging to see the state rate of residential foreclosures continue to decline,” Jessica Cigna, research and policy director for HousingWorks RI at Roger Williams University, said in a statement. “This is tempered, however, by the number of homeowner households that are still burdened by housing costs.”

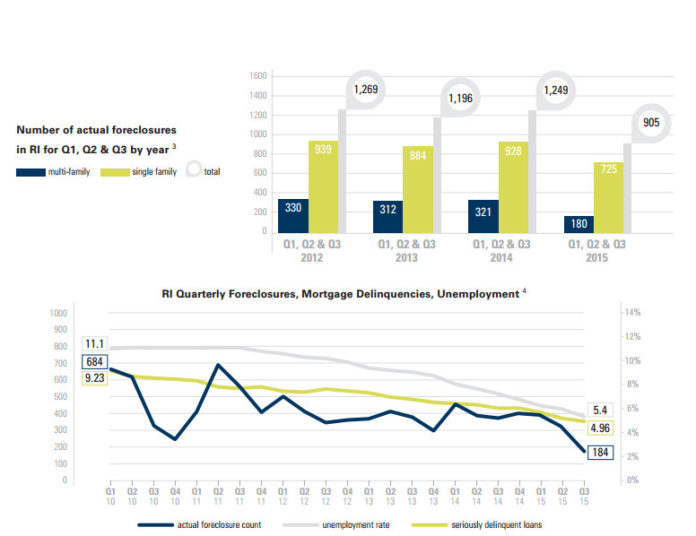

In addition, for the first three quarters of 2015, there were 905 residential foreclosure deeds filed, a decline of 28 percent from the same period a year earlier.

Nine municipalities – Barrington, East Greenwich, Foster, Jamestown, Middletown, North Smithfield, the East Side of Providence, South Kingstown and West Greenwich – reported increases in foreclosure deeds filed in the first three quarters of 2015 when compared with the year-ago period. Middletown had the largest increase at 1,000 percent, to 11 from one.

One reported no change at all – New Shoreham – while 29 others reported decreases. Portsmouth had the largest decrease at 75 percent, to three from 12.

The percent of seriously delinquent loans in Rhode Island also fell, to 4.96 percent in the third quarter, but was higher than the national seriously delinquent loan rate at 3.57 percent (seriously delinquent loans are those that are 90 days or more behind). It also was second-highest of all the New England states and fifth-highest nationwide, HousingWorks RI said.

Cigna said Rhode Island’s high percentage of “underwater” mortgages, those with balances higher than the home’s value, continue to be an issue. HousingWorks RI said Rhode Island’s statewide percentage of underwater loans, at 12.3 percent, was the fourth-highest in the country in the third quarter, as reported by CoreLogic.

“The high percentage, while down 2.5 percentage points from a year ago, shows that Rhode Island’s housing economy still faces substantial challenges, especially when this statistic is looked at in combination with the percentage of seriously delinquent loans,” Cigna said.

HousingWorks RI’s quarterly report is made possible with support from Rhode Island Housing.