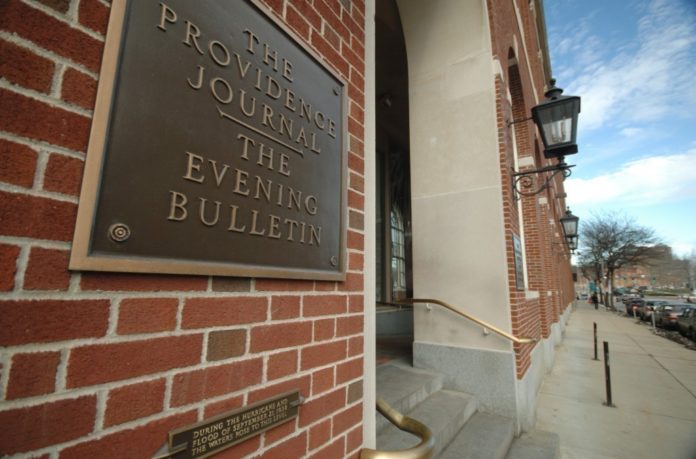

DALLAS – The Providence Journal posted a 2.7 percent gain in first-quarter revenue to $21.2 million, according to a U.S. Securities and Exchange Commission filing made public Wednesday.

The overall gain was driven by 4.7 percent (to $8.3 million) and 19.4 percent (to $3.7 million) gains in circulation, and printing and distribution revenue, respectively, as the company increased its home delivery rate by 19.1 percent, an increase that was offset by a decline of 10.5 percent in the number of newspapers delivered. Single-copy sales volume declined 8.3 percent as well, as the price for a single edition of the Journal increased 1.6 percent. In addition, the company continued to collect increased revenue from distribution contracts for other newspaper and magazines that began in July 2013.

On the other hand, the Journal saw a decline in advertising and marketing services revenue of 4.4 percent to $9.1 million. The company supplied a breakdown of the decline, showing drops in display advertising of 0.8 percent (to $2.3 million), classified of 5.4 percent ($3.1 million) and preprint of 8.7 percent ($2.4 million). Digital revenue, however, gained 0.9 percent to $1.3 million in the quarter. Belo noted that retail display advertising fell in the period, but the drop was offset by increased general advertising. The preprint advertising revenue decline was consistent, the company said, with circulation declines.

While Belo did report a net loss of $4 million for the period, it did post a gain in cash flow from operations in the three-month period, from $933,000 to $3.4 million. In addition, the publisher increased the amount of money it paid in dividends to shareholders, which totaled $1.8 million in the 2014 first quarter, compared with $1.4 million in the year-earlier period. Belo also paid $675,000 to repurchase 75,228 shares of Series A stock, noting that none of the shares were repurchased “directly” from company officers or directors.

By the end of the first three months of 2014, the company had no debt and had increased is cash and cash equivalents over the year 159 percent to $82.5 million, a benefit of completing the sale of the Press-Enterprise in Riverside, Calif., late in 2013, as well as its sale of Apartments.com.

The company also reaffirmed its commitment to sell the Journal during its call Tuesday after the release of its earnings statement. Senior Vice President/Chief Financial Officer Alison K. Engel responded to a question about how long the company would stick with the sale process, saying that the company “was nowhere near abandoning the effort” to sell the Journal.

“We’re midway through the process,” she said, “and it’s going very well.”