SOUTH KINGSTOWN – The state’s economic momentum in April “deteriorated noticeably,” said University of Rhode Island economist Leonard Lardaro in his latest Current Conditions Index.

Scheduled for release Monday, the April 2016 CCI corrected last month’s value from 58 to 50, a neutral reading, and gave April a 42, a “level that indicates contraction,” said Lardaro.

This is the lowest CCI value measured in Rhode Island since October 2011.

In April 2015 the CCI was 67, representing a 25-point drop in year-over-year measurements.

CCI measurements higher than 50 suggest economic growth; a value below 50 indicates contraction.

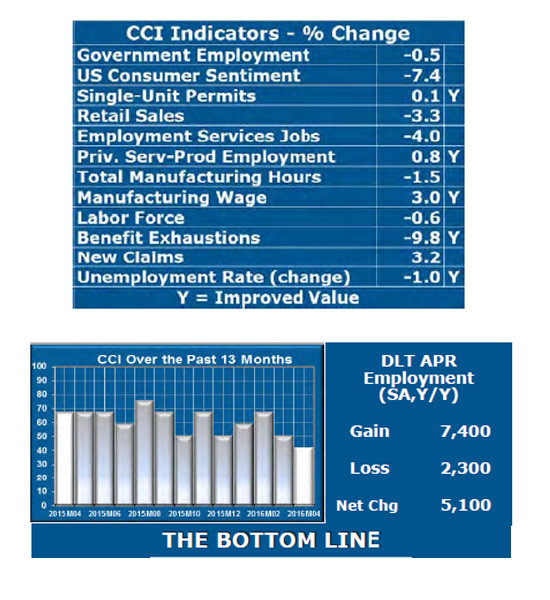

Each month’s measurement reflects 12 broad-based indicators of economic activity including consumer sentiment, the unemployment rate, retail sales and government employment.

The Rhode Island unemployment rate fell 1 percentage point in April over the year to 5.3 percent from 6.3 percent.

Sectors experiencing growth last month included manufacturing wage, which saw 3 percent growth year over year, and private service-producing employment, which saw a 0.8 percent increase over the year.

Four out of five leading indicators failed to improve in April, said Lardaro, and the one leading indicator that did improve, single unit permits, rose 0.1 percent compared with last year.

Other leading indicators are employment service jobs, total manufacturing hours, new claims and U.S. consumer sentiment.

Employment service jobs, including temporary employment, witnessed a 4 percent drop, its second decline in two months. While employment in the manufacturing industry rose slightly, total manufacturing hours, which mirrors manufacturing output, fell 1.5 percent, “resuming its downward trend that began over a year ago,” said Lardaro.

New claims, which indicates layoffs, increased 3.2 percent, and U.S. consumer sentiment fell last month by 7.4 percent, its fifth consecutive decline.

Retail sales, which has declined in three of the past four months, fell 3.3 percent in April, the worst performance it has had in more than a year. The labor force continued its decline, falling 0.6 percent in April, representing the 23rd year-over-year decline for the indicator and government employment fell by 0.5 percent.

Benefit exhaustions, reflecting longer-term employment, fell 9.8 percent over the year.

Regarding benefit exhaustions, Lardaro said: “While this is still a very healthy rate of improvement, April’s value was its second-slowest rate of improvement in the past eight months.”

While he classified April as “concerning,” Lardaro warned against jumping to conclusions.

He added, “if the national economy accelerates, our state’s performance should also improve, hopefully ending this recent period of weakness.”