PROVIDENCE – Bad news for renters in the Providence metro and in Rhode Island.

Make Room, a nationwide campaign focused on American renters, released a study on Thursday showing that over the past decade, U.S. metro areas with populations less than 2.5 million have faced the largest increase in the share of renters paying more than half of their household income (before taxes) toward rent and utilities.

In a list of the top 10 U.S. metros with the fastest-growing share of severely burdened renters, the Providence-Warwick-Fall River metropolitan area ranks eighth, with a 4.3 percentage point increase in severely burdened renters from 2005 to 2014, leaving 27.2 percent of renters paying more than half their income for housing.

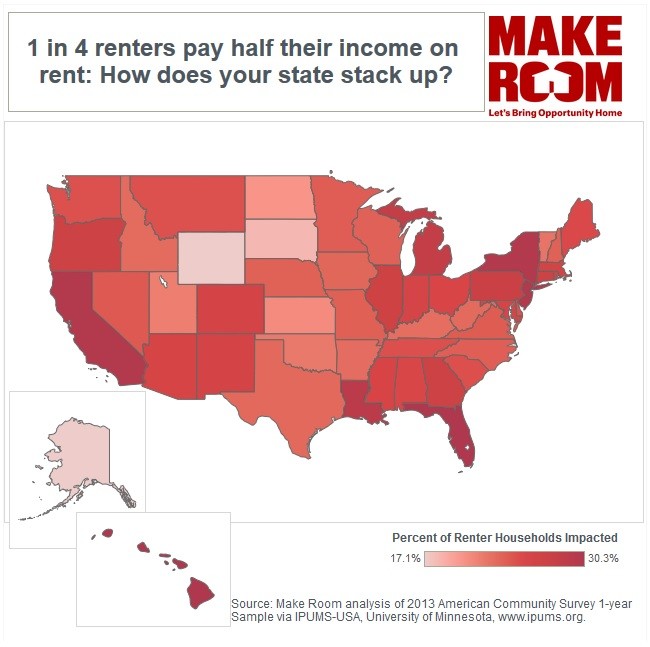

Rhode Island ranks even higher, at seventh in the top 10 list of states with the fastest-growing share of severely burdened renters, with a 4.4 percentage point increase to 28.2 percent from 2005 to 2014. Hawaii ranks the highest among states, with a nearly 7 percentage point increase to 29 percent of severely burdened renters.

Among metros, Jacksonville, Fla., ranked highest, with a 7.2 percentage point increase to 28.4 percent, followed by Richmond, Va., with a 6.2 percentage point increase to 26.8 percent of renters being severely burdened.

Nationally, 11.4 million families, or 26.4 percent of the 43.1 million U.S. renter households, spend at least half their income on rent according to 2014 Census data, the latest available, an increase from 11.2 million in 2013.

“The shortage of affordable rental homes is a worsening, nationwide problem that must be addressed. Focus tends to center around affordability issues in high-density, high-cost coastal cities, but the data shows that mid-size cities across the country have felt the squeeze most during the past decade,” Angela Boyd, managing director of Make Room, said in a statement.

The Make Room campaign, launched last May, is advocating for policies such as inclusionary zoning and dedicated funding sources to encourage new construction and preservation of existing affordable homes. That would complement federal resources for affordable housing, such as rental assistance vouchers and tax credits for developers, which keep rents affordable to families earning lower incomes, Make Room said in a press release.

Make Room said that in many cities, wages for lower-paid workers have not kept up with a nationwide trend of rising rents.