PROVIDENCE – Private-industry employer costs for employee compensation in New England inched downward in December, dropping 8 cents per hour to an average of $34.40 per hour, but remained the highest in the U.S., according to a quarterly U.S. Bureau of Labor Statistics report issued Wednesday.

The national average of compensation costs in December was $29.63 per hour. Regionally, compensation costs in the Northeast – including data from New Jersey, New York and Pennsylvania, as well as New England – averaged $33.87 per hour.

In September, New England’s employer costs averaged $34.48 per hour, while the Northeast average was $33.40 per hour and the national average was $29.23 per hour.

Employer costs for employee compensations data are based on the National Compensation Survey, which measures employer costs for wages, salaries and employee benefits. Benefits include insurance costs, Social Security and Medicare, compensation, unemployment insurance, and paid leave benefits.

Wages and salaries accounted for 70 percent of all employer costs in New England in the December report, averaging $24.05 per hour, while employee benefits accounted for the rest. Out of that 30 percent, legally required benefits such as Social Security, Medicare and unemployment insurance accounted for 8.1 percent of all employer costs, while health insurance accounted for 7.5 percent and paid leave accounted for 7 percent.

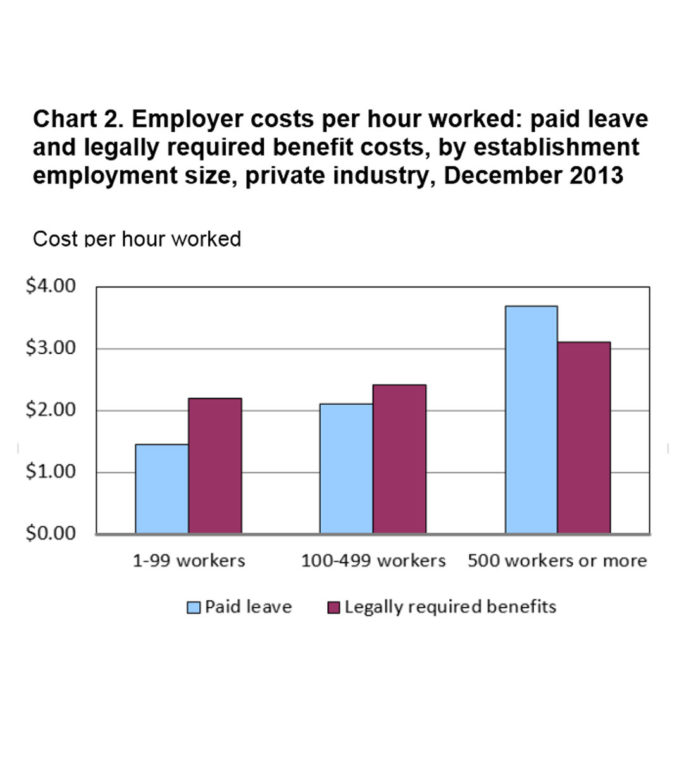

In general, the BLS report indicated, paid leave accounts for a greater percentage of total employer costs the more people a company employs. Paid leave costs for establishments with fewer than 100 workers accounted for 5.9 percent of total costs, compared with 7.1 percent for establishments with between 100 and 499 employees and 8.4 percent for companies with 500 employees or more.

Legally required benefits, conversely, account for a smaller percentage of total costs at companies that employ more people. Employers with fewer than 100 employees said legally required benefits constituted 8.9 percent of total costs. That figure dropped to 8.1 percent for employers with between 100 and 499 employees and to 7.1 percent for employers with 500 or more workers.

Nationally, the East South Central region – which includes Alabama, Kentucky, Mississippi and Tennessee – had the lowest employer compensation costs in September, averaging $24.27 per hour.