HERE. / COURTESY R.I. PUBLIC INTEREST RESEARCH GROUP" title="OFFSHORE TAX havens cost every Rhode Island taxpayer an average of $532 a year and each small business $2,766 per year, according to a report released Thursday by the R.I. Public Interest Research Group. For a larger version of this chart, click HERE. / COURTESY R.I. PUBLIC INTEREST RESEARCH GROUP"/>

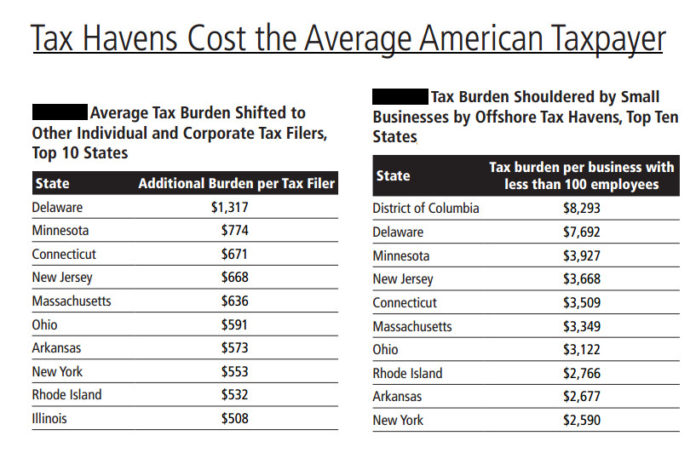

HERE. / COURTESY R.I. PUBLIC INTEREST RESEARCH GROUP" title="OFFSHORE TAX havens cost every Rhode Island taxpayer an average of $532 a year and each small business $2,766 per year, according to a report released Thursday by the R.I. Public Interest Research Group. For a larger version of this chart, click HERE. / COURTESY R.I. PUBLIC INTEREST RESEARCH GROUP"/>PROVIDENCE – Offshore tax havens cost every Rhode Island taxpayer an average of $532 a year and each small business $2,766 per year, according to a report released Thursday by the R.I. Public Interest Research Group.

“The average Rhode Island taxpayer would have to shoulder an extra $532 tax burden to make up for revenue lost from corporations and wealthy individuals shifting income to offshore tax havens,” said the RIPIRG report, “Picking up the Tab.”

Individually, Rhode Islanders paid the ninth most in the country because of offshore tax shelters. Residents in Delaware, Minnesota, Connecticut, New Jersey, Massachusetts, Ohio, Arkansas and New York were worse off, respectively, paying from $1,317 in Delaware to $553 in New York.

“Offshore tax havens enable wealthy special interests to avoid contributing their fair share in taxes and unfairly burden our small businesses, innovators and entrepreneurs,” Rep. David Cicilline (D-R.I.) said in a prepared statement.

Rhode Island’s small businesses paid the eighth most in the country annually to make up for the revenue lost from offshore tax havens.

The Ocean State was behind the District of Columbia – whose small businesses shoulder an average $8,293 a year due to tax shelters – Delaware, Minnesota, New Jersey, Connecticut, Massachusetts and Ohio.

“When corporations shirk their tax burden by using accounting gimmicks to stash profits legitimately made in the U.S. in offshore tax havens like the Caymans, the rest of us must pick up the tab,” said Ryan Pierannunzi, an associate with RIPIRG.

“Responsible small businesses don’t just foot the bill for corporate tax dodging, they are put at a competitive disadvantage since they can’t hire armies of well-paid lawyers and accountants to use offshore tax loopholes,” he continued.

The RIPIRG report recommends closing a number of offshore tax loopholes that the nation’s largest companies – including Google, General Electric and Wells Fargo – use to get out of paying their “fair share” of federal taxes.

“It is appalling that these companies get out of paying for the nation’s infrastructure, education system, security, and large markets that help make them successful,” added Pierannunzi.

To view a copy of the full report, visit www.ripirg.org.