CLICK HERE. / " title="RHODE ISLAND is one of the most financially distressed states in the nation, according to the Consumer Distress Index. For a larger version of this chart, CLICK HERE. /"/>

CLICK HERE. / " title="RHODE ISLAND is one of the most financially distressed states in the nation, according to the Consumer Distress Index. For a larger version of this chart, CLICK HERE. /"/>PROVIDENCE- Rhode Island is one of the most financially distressed states in the nation, according to a new consumer distress index published Thursday by the nonprofit credit counseling service CredAbility.

The Ocean State ranked 15th on the index with a score of 63.7 out of a 100 points in the second quarter. A score below 70 indicates a state of financial distress, CredAbility noted.

Massachusetts was distressed as well, scoring 68.4 points. But the Bay State was better off than most, coming in at No. 35 on the list.

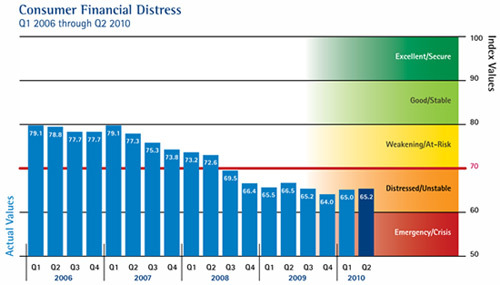

The national score rose from 65.0 to 65.23 points in the quarter but was slightly lower than the 2009 second quarter, which registered 66.5 points.

“The average American remains gripped by financial distress,” said Mark Cole, chief operating officer of CredAbility. The average U.S. consumer has been in financial distress for eight consecutive quarters, he said.

The factors weighing on Rhode Island’s score include scores higher than the national average for unemployment rate in the period, 12.3%; mortgage delinquency, 10.4%; and underemployment rate, 6.6%.

“Underemployment, which measures people working in jobs that they are overqualified to do, is high in Rhode Island,” Cole told Providence Business News. The state did above average, however, in measures of credit and income.

Rhode Island’s financial distress bottomed out in the fourth quarter of 2009 at 63.2 points. Despite small gains, it has yet to recover to levels seen a year ago.

“Rhode Island can expect to follow the national trend in the next quarter. Things are not getting significantly worse but also, not significantly better,” said Cole, adding that the key to turning around the local economy is employment.

Nevada posted the worst score on the index at 59.2, points while North Dakota noted the least amount of financial distress with 78.9 points.