OAKTON, Va. – Rhode Island’s public policies important to small businesses and entrepreneurs are among the worst in the nation, according to the Small Business Survival Index 2011.

The Ocean State slipped to No. 47 on the 16th annual ranking produced by the Small Business and Entrepreneurship Council from No. 45 last year.

The index weighs 44 “government-imposed” or government-related costs affecting small businesses and entrepreneurs across a broad spectrum of industries and types of businesses.

“At the federal, state and local levels, the biggest obstacle to entrepreneurship and investment usually is public policy gone awry,” said Raymond J. Keating, author of the index.

“While most politicians talk a good game about entrepreneurship and small businesses, public policy too frequently raises costs, creates uncertainty and diminishes incentives for starting up, investing in and building a business,” he said, adding: “And it’s not just elected officials at the federal level that cause problems. It certainly occurs at the state and local levels as well.”

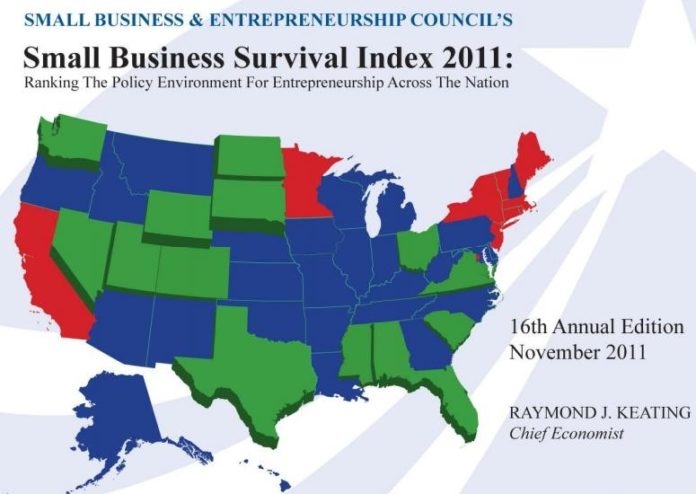

The top five friendliest states for business were, in order: South Dakota, Nevada, Texas, Wyoming and South Carolina.

On the other hand, the worst in the nation for small business and entrepreneurs was the District of Columbia. Keating also noted in a footnote that the District of Columbia was “not included in the studies on the states’ liability systems, eminent domain legislation and highway cost efficiency, so D.C.’s last place score actually should be even worse.”

Following Rhode Island on the bottom rungs were: Vermont, No. 48; New Jersey, No. 49; and New York, No. 50.

Factoring into Rhode Island’s score were:

- High corporate income and corporate capital gains taxes.

- High property taxes.

- Imposes a state estate tax.

- High unemployment taxes.

- High gas and diesel taxes.

- High wireless taxes.

- Highest number of health insurance mandates.

- High electric utility costs.

- High gas and diesel taxes.

- High level of state and local government debt.

- High level of federal revenue as a share of total state and local revenue.

- Poor private property protections.

- Relatively low workers’ compensation costs.

- Fairly low level of state and local government employees.

- Low five-year rate of increase in state and local government spending.

- No individual and corporate alternative minimum taxes.

For the full report, click here.

The Council publishes its statements to lawmakers here:

http://www.sbecouncil.org/legaction/

The statements indicate:

— support for hydraulic fracturing which is known to destroy drinking-water supplies;

— opposition to raising fuel-economy standards to levels competitive with Europe and Asia;

— opposition to most taxes, including those that cover the government’s costs of supporting business infrastructure and waste transfer.

The states that are ranked highest on the Council’s list — South Dakota, Nevada, Texas, Wyoming and South Carolina — happen to be the same states that receive the most taxpayer money from other states via federal transfer. In other words, these low-tax states collect far more federal money than they receive, and shift their net tax burdens onto higher-tax states like Rhode Island.

So again, PBN subscribers would have benefitted from an objective analysis of the report — not a parroting of the Council’s press release. When will we subscribers receive this reporting?