PROVIDENCE – Rhode Island’s foreclosure inventory was 1.6 percent in February, slightly above the national average of 1.4 percent, according to CoreLogic.

Rhode Island’s foreclosure rate also dropped half a percentage point from a year ago.

There were 1,441 completed foreclosures in Rhode Island for the 12-month period that ended in February compared with 1,619 completed foreclosures from the same period a year ago.

Rhode Island’s serious delinquency mortgage rate was 5.5 percent in February, and while that fell six-tenths of a percentage point from last year, it was 1.5 percentage points higher than the national rate of 4 percent. A seriously delinquent mortgage is more than 90 days behind the payment schedule.

Nationwide, foreclosure inventory declined 27.3 percent year over year, and completed foreclosures decreased 15.7 percent during the same time period, CoreLogic reported.

There were 39,000 completed foreclosures nationwide in February compared with 46,000 in February 2014, representing a decrease of 67 percent from the peak of completed foreclosures in September 2010.

According to CoreLogic, since the financial crisis began in September 2008, there have been approximately 5.6 million completed foreclosures across the country, and since homeownership rates peaked in the second quarter of 2004, there have been approximately 7.7 million homes lost to foreclosure.

As of February, the national foreclosure inventory included approximately 553,000 homes compared with 761,000 homes in February 2014.

“The number of homes in foreclosure proceedings fell by 27 percent from a year ago and stands at about one-third of what it was at the trough of the housing cycle,” Frank Nothaft, chief economist at CoreLogic, said in a statement. “While the drop in the share of mortgages in foreclosure to 1.4 percent is a welcome sign of continued recovery in the housing market, the share remains more than double the 0.6 percent average foreclosure rate that we saw during 2000-2004.”

Said Anand Nallathambi, president and CEO of CoreLogic, “What’s encouraging is that fewer Americans are seriously delinquent in paying their mortgages, which in turn is reducing the foreclosure inventory across the country as a whole.”

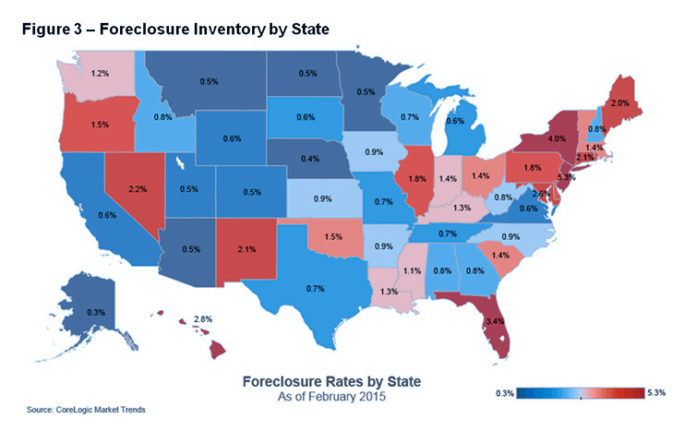

Florida had the highest number of completed foreclosures for the 12 months ending in February with 110,000, while South Dakota had the lowest with 15. New Jersey had the highest foreclosure inventory as a percentage of all mortgaged homes at 5.3 percent, while Alaska had the lowest foreclosure inventory as a percentage of all mortgaged homes at 0.3 percent.