PROVIDENCE – The R.I. Public Expenditure Council recommends that the state fund the education funding formula in fiscal 2012, but reconsider the cost of other new programs that are part of Gov. Lincoln D. Chafee’s budget proposal before approving them.

“Funding of the state’s recently-enacted funding formula should be a priority,” the nonprofit research organization said in a four-page brief released Thursday.

“In addition to fulfilling the statutory requirement to implement the formula in fiscal 2012 [at a cost of $17 million], support of the education funding formula represents the kind of long-term investment RIPEC has advocated.”

Repayment of the Rainy Day Fund at $22 million in the current fiscal year should also be a priority, RIPEC said.

In the report, RIPEC outlines the approach it feels should be taken to finalize state budgets for the current fiscal year ending June 30 and the 2012 fiscal year starting July 1.

Its analysis includes changes in business taxes as the governor has proposed, including reduction of the corporate tax and combined reporting. The report takes into account the latest revenue projections for fiscal years 2011 and 2012, newly revised in May.

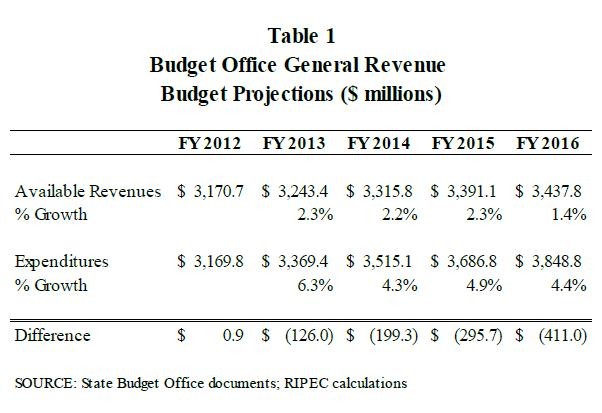

Warning of a projected cumulative deficit of $411 million by fiscal year 2016, RIPEC said that the state is on track to end the current fiscal year with a $66.7 million surplus, but “these funds should not be used to support programs that will create or increase … deficits; repayment of the Rainy Day Fund [at $22 million] should be a priority,” a move that would drop the surplus to $44.7 million, RIPEC noted.

A $184.7 million surplus is forecast for 2012, according to RIPEC, assuming the sales tax is expanded as Chafee has proposed and no new initiatives are funded. Without the sales tax increase, fiscal 2012 would end with a positive balance of approximately $19 million.

But in 2012, Chafee has proposed $66 million in new initiatives, such as: the Municipal Accountability, Sustainability and Transparency initiative, at a $19.3 million cost; Tourism Asset Protection, for capital projects related to the tourism industry, $2.6 million; establishment of dedicated funding for the state Department of Transportation, $12 million; support for Central Falls, $4.9 million; education funding formula, $17 million; and $10 million for higher education.

The research agency warns that new revenue will fail to keep pace with the cost of the new programs.

“By fiscal 2016, the net impact of these programs … is a net decrease in available revenue by $43.9 million, or approximately one-tenth of the projected deficit,” the study says. This estimate does not include increased funding to meet pension obligations, expected to increase by roughly $100 million in fiscal year 2013, the study notes.

What RIPEC recommends is that policy-makers carefully assess each newly proposed initiative for its cost and merits and whether any can be implemented without additional expense. In some cases, RIPEC suggested compromise solutions to limit expenses, such as implementing some parts of MAST but not others and creating a dedicated DOT fund but not funding it until fiscal year 2013.

The agency recommends a dedicated source of funding for local education aid, such as revenue generated through the 8 percent hotel and meals tax, similar to the proposed MAST funding. “This would both ensure that growth in the funding formula would be supported by a dedicated revenue source, and that locally-generated revenue is used to support local initiatives,” RIPEC said.

RIPEC is a nonprofit, nonpartisan public policy research and education organization, funded in large part by major business corporations in the state.