CHICAGO – A new study has found that senior citizens’ incomes fail to meet a generally accepted threshold for comfortable living in nearly every state, with Rhode Island ranking third worst in the nation, consumer finance website Interest.com announced Monday.

The Interest.com study operated from the notion that retirees need 70 percent of the annual funds they received while working. Investigators compared the median annual household income for people age 65 and older to that for people between 45 and 64.

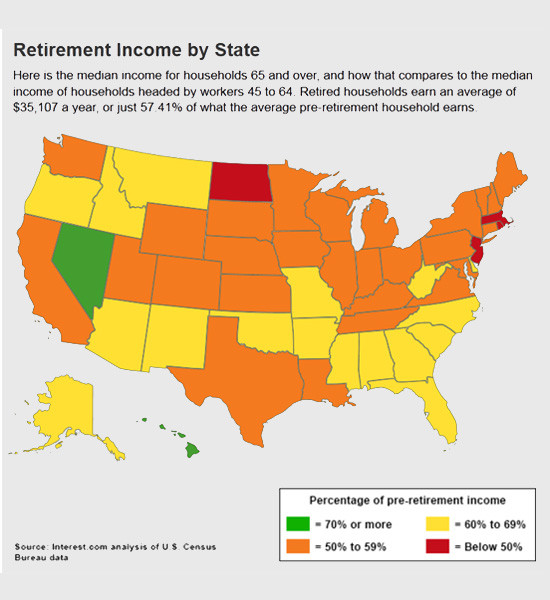

By that standard, 48 states and the District of Columbia fell short, with only Nevada and Hawaii clearing the 70 percent benchmark.

Massachusetts was worst in the country, with senior citizens taking home barely 45 percent of their younger peers. But Rhode Island was not far behind, at 48.2 percent. North Dakota and New Jersey were the only other states to fall below 50 percent.

The national average was 57 percent.

These numbers posed such a threat, the study’s conductors concluded, because senior citizens must pay the same prices as younger people for most goods and services. In addition, “many senior citizens are significantly underfunded and risk running out of money, especially since people are living longer than they used to and may need to support a two- or three-decade retirement,” Mike Sante, managing editor of Interest.com, said in a statement.

The study pinpointed senior citizens’ sources of income as the principal cause of this resource disparity. The majority of retirees now rely on Social Security as their leading source of income, rather than pensions or personal savings. And at the beginning of 2012, the average monthly Social Security payment for a retiree was just $1,230.

To view the full report, visit: www.interest.com.