PROVIDENCE – Car insurance costs 102 percent more on average after Rhode Island couples add a teen driver to their policy, which is the fifth highest increase in the country, according to an insurancequotes.com report.

Depending on whether one has a son or a daughter also makes a difference, as teenage males lead to 120 percent higher car insurance costs in Rhode Island, while teenage females lead to 84 percent higher costs.

Insurancequotes.com said that the difference for U.S. families to insure teen drivers has been roughly the same over the last three years. In 2013, it cost 85 percent more to add a teen driver to a policy, while that premium was 79 percent last year and is 80 percent more today.

The report said that 16-year-olds cause the highest spike in premiums – 96 percent – on average for U.S. families, while the average impact decreases to 60 percent at age 19.

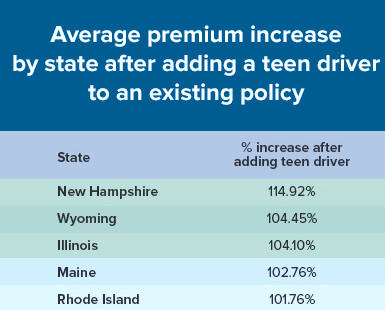

The most expensive state to insure a teen driver is New Hampshire, where the average premium jumps 115 percent. Wyoming was second at 104.5 percent, followed by third place Illinois at 104 percent, fourth place Maine at 103 percent and Rhode Island, fifth with 102 percent.

“It’s really expensive to insure a teen driver, but good student discounts can take some of the sting out of these bills,” Laura Adams, senior analyst, insuranceQuotes.com, said in a statement. “I’ve seen discounts as high as 25 percent for students who maintain at least a B average in high school or college. Students and their parents need to proactively request this discount.”

Hawaii is the only state that does not allow age and length of driving experience to affect car insurance costs. As a result, teen drivers there cost 17 percent more to insure, the lowest increase in the nation, according to the study.

New York has the second-lowest increase at 53 percent, followed by Michigan, 57 percent; North Carolina, 60 percent; and New Mexico, 60.4 percent.

InsuranceQuotes.com commissioned Quadrant Information Services to calculate rates using data from the largest carriers in each state.

Averages are based on a married and employed 45-year-old male and 45-year-old female who each drive 12,000 miles per year with policy limits of $100,000 for injury liability for one person, $300,000 for all injuries and a $500 deductible on collision and comprehensive coverage. The hypothetical drivers have clean driving records and good credit.