Rhode Island chief financial officers echo the restrained expectations for economic growth in 2013 found in two national surveys of finance executives. America’s stubborn economic issues are weighing heavily on regional growth, some local financial leadetrs said.

“I don’t see a lot of positive things happening economically. You’ve got this sequestration. You’re looking at major cuts. They reinstituted 2 percent of the FICA taxes. To me, there’s still a lot of drag on the national economy at this point,” said Navigant Credit Union Chief Financial Officer Daniel O’Brien. “I don’t see Rhode Island or southeastern Massachusetts outperforming the national economy.”

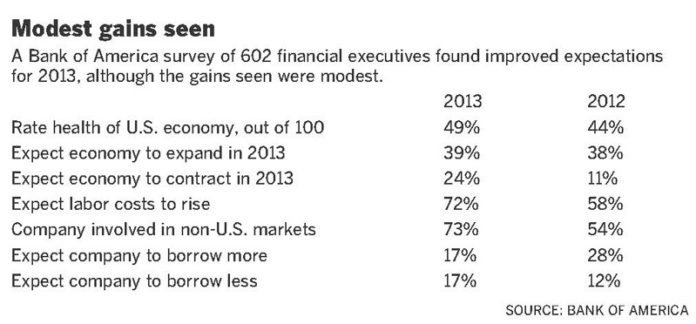

In a survey of 602 financial executives polled in the “Bank of America Merrill Lynch 2013 CFO Outlook,” only two out of five said they are expecting economic growth in 2013.

The survey found 24 percent of the executives said they expect the economy to contract this year, up significantly from 11 percent in 2012.

“It is clear that uncertainty continues to linger among CFOs, which is understandable given the broader economic issues both in the U.S. and overseas,” Alastair Borthwick, head of Global Commercial Banking at Bank of America Merrill Lynch, said in a press release. “Unless they see solid evidence of stability, CFOs will be guarded in their optimism and growth plans. Expansion is still possible, but may be limited in the short-term to certain industries and markets.”

A slightly more optimistic outlook, at least in comparison to the past few years, surfaced in a national survey conducted by TD Bank. The survey of 303 finance executives was conducted by ORC International in November and December 2012.

Forty-six percent of finance managers polled by TD Bank said they are more optimistic about U.S. economic growth in 2013 compared to 2012.

The TD Bank survey found most middle-market and corporate financial decision-makers said their companies have accumulated at least a modest stockpile of cash.

Navigant Credit Union’s O’Brien said that has to be considered in perspective.

“We’re pretty liquid. We’ve got a fairly sizeable investment portfolio. It’s there because we haven’t been able to lend it out as quickly as we’d like,” said O’Brien. “We do have plans for growing our loan portfolios this year, which will take up some of that cash.”

Navigant, which has 13 Rhode Island branches and customers also from south central and southeastern Massachusetts, has seen an increase in mortgage refinancing as homeowners take advantage of low interest rates.

“We’re doing a significant number of refinances, but that doesn’t necessarily allow you to grow your loan portfolio,” O’Brien said. “You’re taking the same mortgage and rewriting it at a lower interest rate.”

The TD Bank survey found the majority of planned capital expenditures in 2013 are geared to technology. Fifty-four percent of executives in that survey said technology tops the priority list.

People’s Credit Union Chief Financial Officer Brian Hennessey said his organization will execute technology improvements in 2013 that have already been planned.

Navigant Credit Union is also continuing investments in technology in 2013, with a data-processing conversion that began in 2012 and is expected to be completed in 2013, O’Brien said.

The TD Bank survey found 26 percent of the finance leaders expect capital expenditures in hiring in 2013.

Navigant Credit Union might add a couple of operational positions in 2013, said O’Brien. The organization took on 25 employees recently as a result of three mergers, the most recent one with Columbus Credit Union in Warren as of Jan. 1, 2013, bringing the staff up to about 240.

In its nationwide survey, TD Bank found 34 percent of CFOs expect capital to be used for improvements to existing facilities in 2013 and 24 percent said they expect it to be used for construction of new facilities.

Mergers and acquisitions were anticipated by 24 percent of the executives at companies with revenues over $500 million, according to the TD Bank survey.

The Bank of America Merrill Lynch survey predicted merger and acquisition activity would pick up slightly in 2013, with 22 percent of CFOs polled expecting to participate in a merger or acquisition in 2013, up from 18 percent a year ago.

The Bank of America Merrill Lynch survey was conducted by Granite Research Consulting with finance executives selected randomly from U.S. companies with revenues between $25 million and $2 billion.

The survey found the top reasons cited for not hiring additional employees in 2013 were insufficient customer demand, uncertainties about higher health care costs and worries about the sustainability of the economic recovery.

“I don’t think the Rhode Island economy is going to grow much in 2013,” Hennessey said. “As a country, we have some serious economic issues that need to be resolved before we see real growth. Tepid growth is one thing. But the end of the recession, I think that’s going to be happening in future years, not in 2013.” •

No posts to display

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.