Of all the ways that Warwick’s T.F. Green Airport could grow, the best hope might not be through the long-awaited runway expansion, but the inevitable build-out of Logan International Airport in Boston.

Rhode Island’s commercial airport has sputtered along for the past decade, losing passenger traffic and flights regularly along the way. Analysts and Green officials say the reasons include airline-industry consolidation, which pulled flights and carriers from mid-sized markets such as Providence, and favored larger international airports.

Will the convenience to passengers of smaller, easier-to-navigate Green pay off eventually? Airport officials argue they have the demand for more service, but need to convince airlines that their flights will be profitable if they service Rhode Island.

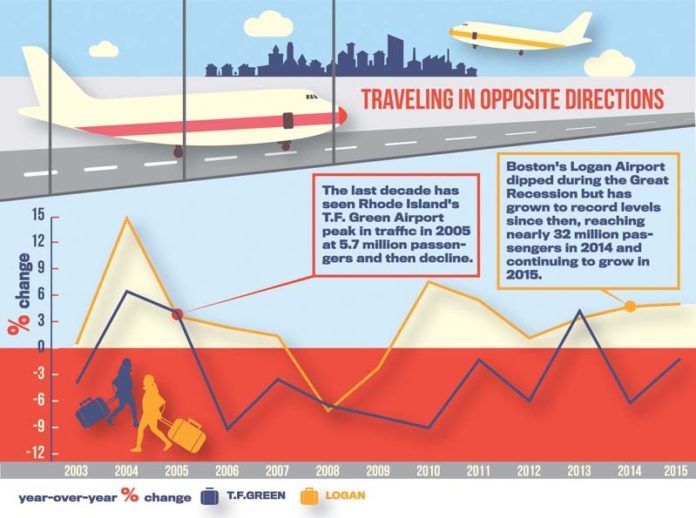

In 2005, when Green had its peak year for passengers, 5.7 million people traveled through the airport. It supported 111 daily departures, and 11 airlines operated routes.

This year, 3.5 million passengers are projected to use the airport. Daily departures have dropped to 53, while five airlines offer year-round service.

Passenger traffic has fallen every year since 2005, except for a slight rise in 2013. So far this year, through August, the traffic remains below the same period in 2014, despite the establishment of international service in June that attracted new passengers.

A study of passenger traffic in 2012 found Green was capturing 57 percent of potential travelers’ business in its primary geographic market, the area within a 45-minute drive of the airport. That means that nearly half of those people were flying into and out of somewhere else. The traffic most likely went to Boston, according to Kelly J. Fredericks, president and CEO of the R.I. Airport Corp., which operates Green.

“What has changed is the industry, completely,” he said. “The airlines have abandoned nonprofitable routes. They’ve gone to more of a connecting hub, and they’ve even abandoned some of the connecting hubs over the past decades. They’ve gone to smaller aircraft in some circumstances.

“What it all boils down to is there are a lot less planes and lot less seats in the market than there was a decade ago,” he said.

REGIONAL CHALLENGE

Analysts say Green has some advantages. Whether it can rebuild its traffic levels to anything approaching the mid-2000s peak is another matter.

Mike Boyd, president of Boyd International Group, a Colorado-based aviation consulting firm, said the traffic experienced by Green in the early to mid-2000s was the result of Logan being a difficult airport to access and the decision of Southwest Airlines to serve New England through Manchester, N.H., and Providence, rather than Boston.

In the years since, Logan gained discount airlines, including Southwest. The Big Dig was completed, and Logan airport became easier to reach.

Passenger traffic at Logan has grown annually since 2009, buoyed in recent years by as much as 10 percent yearly growth in international business, according to statistics provided by the Massachusetts Port Authority, which operates the airport.

In the year to date, through August, Logan had 5 percent more international flights, and 10 percent more passengers on international carriers. The total passenger counts are 5 percent higher so far this year, and grew by 5 percent last year.

“Passengers are returning to Logan; that’s what has to be recognized here,” Boyd said. “At the time, Logan had no low-cost service. Getting through Logan was a magical mystery tour of construction. The Callahan Tunnel? It was a mess.”

What Green now faces are not internal issues, but issues related to competition from Boston, he said. “It’s not that T.F. Green has gone downhill. It’s that Boston has gone uphill.”

Despite the pattern of declining passenger counts, Fredericks remains confident the airport will recapture at least some of the business lost to Boston. The airport 65 miles from Green is the primary competition, he said, rather than other small to midsized airports in New England.

“Logan can continue to expand, but I contend that it can’t expand enough, over time, to meet all of the future demand,” Fredericks said.

For one thing, Boston can only grow so much, Fredericks said. The Hub’s airport is pressed up against Boston Harbor, and landlocked. At some point, demand for travel will exceed its capacity, and Green will be the likely beneficiary.

Compared to Logan, Green scores points for access, he said. It was ranked among the best airports in the United States for ease of its check-in process and connections via rail to Boston, and Providence, according to Conde Nast Traveler and Travel and Leisure magazines.

And the flights are full. Carriers are flying planes at 90 percent of seat capacity, according to RIAC. The demand is strong for additional service. It’s a case of selling Green to airlines that are cost-conscious and fielding similar requests from other airports, Fredericks said.

“T.F. Green does not have a demand problem,” he said. “We have a capacity problem. We don’t have enough seats in our market.”

THE (FLIGHT) PATH FORWARD

What’s happening behind the scenes is a combination of market analysis and salesmanship. He said airport officials are continually meeting with carriers, making the case that Rhode Island’s population density and its nearly full planes are signs of consistent demand for larger planes and more frequent service.

“Route analysis has to demonstrate to the air carrier that if you give us a bigger aircraft, it’s going to make money,” Fredericks said. “There are probably 15 to 20 other airports out there, in their respective markets, pitching a similar business case for limited seats in aircraft.”

T.F. Green has offered incentives, such as a waiver of airport gate fees, to help lure additional service. Both of the international carriers that started business in June at Green received such incentives.

In June, Condor Airlines began service between Rhode Island and Frankfurt, Germany. The same month, Cabo Verde Airlines started direct service between Green and the island of Santiago.

About 18,551 passengers took advantage of the international services through August, according to the airport’s statistics.

Condor, which operated direct flights to Rhode Island on Mondays and Thursdays, flew 944 passengers in June, 1,681 passengers in July and 3,924 passengers in August. The airline operates a Boeing 767-300 with 259 seats on its Providence route and finished its initial three-month run with 82 percent of seats occupied, according to Fredericks.

Cabo Verde Airlines had greater success with its introductory service, flying 1,535 in June, 1,658 in July and 2,910 in August. It had flights that were 95 percent full, according to Fredericks, which wasn’t unexpected. Green attracted the airline from a berth at Logan, where it had operated since 1987.

Both carriers will return for a second year of service in the summer of 2016, according to Fredericks.

Titus Johnson, vice president for North America and Caribbean for Condor Airlines, said the airline was satisfied with its inaugural summer and had expected a slow ramp-up.

“We knew, with a new airport, it was going to take longer for the awareness of the region, particularly for European businesses,” Johnson said. “It’s the first time ever there had been a flight to Rhode Island from Europe. We still need the customer base in Europe to understand what Rhode Island has to offer.”

For Condor, a full-service, economy fare carrier, Green provides more efficiencies than Boston, he said. “It’s small. It’s efficient. It’s faster,” he said. “Passengers can be out of the airport quicker than going through larger hubs.” European vacationers, he noted, typically take two weeks at a time, and are interested in fly-drive vacations, for which Rhode Island offers a fine gateway to New England.

Overall, the international travelers account for a tiny proportion of the Green base. The two carriers, together, made up about 2 percent of the airport’s market share in August.

LOOKING HOMEWARD

While the international carriers provide additional traffic, the airport is not trying to position itself as an international destination.

“Our future and our growth is going to come from domestic service. The international is seen as icing on the cake. Every little bit helps, but we’re not going to become an international mecca,” said Fredericks.

The focus of additional service remains transcontinental flights, including nonstop service to cities that Rhode Islanders most want. The top focus for additional service is Dallas-Fort Worth, the hub for American Airlines.

Airport officials have had meetings with American, he said, as well as with Southwest Airlines, to pitch service to Denver, Las Vegas and Houston.

Boyd argues that Providence already has great access to destinations in the U.S. and abroad. “We need more passengers? Wait a minute. Time out. You need service that gets passengers to Providence from the rest of the world. That’s all that matters.”

The problem for Green, he said, is the “800-pound gorilla north of you.”

“The problem you have is that Boston is getting more international traffic. China is a big market. If someone is going to fly to China now, it’s probably easier to get on the highway and drive up to Boston and get on the Hainan Airlines, direct to Beijing,” he added.

According to Fredericks, the density of population between Providence and Boston remains a chief selling point. The study that found Rhode Island lost 43 percent of its primary market traffic to other airports in 2012 also found that 26.4 million people flew that year from the Boston primary market, which extends to southeastern Massachusetts and Cape Cod.

If Green could recapture even 5 percent of the Boston market, Fredericks said, it could mean as much as 1.3 million more passengers.

“We’re not looking for monumental increases. If we can get up to 5 percent, it makes a huge difference to us. It has to mean more flights, because our flights are flying full,” he said.

WILL THEY COME?

The $250 million project to extend the primary runway, now under construction, will help the airport expand its market and help airlines increase flight profitability, he said.

The project, scheduled to be completed in December 2017, will extend the primary runway to 8,700 feet, and will immediately guarantee that the airport can remove weight restrictions, which now require aircraft to offload either passengers or fuel. The project will be financed through a combination of federal grants, airport funds and passenger charges.

It will not guarantee new flights, Fredericks said. But the runway length will accommodate international and transcontinental flights, which require the longer distance to lift the heavier fuel and passenger weights.

“Do we think it will bring new service? Absolutely,” he said.

Beyond passenger service, cargo statistics have rebounded.

The airport carried 17.1 million pounds in cargo through August, a slight increase over the 17.2 million pounds carried last year during the same period.

Cargo weights have been climbing consistently at Green since 2010, after a precipitous drop experienced when DHL discontinued its domestic U.S. cargo operations, according to Patti Goldstein, a spokeswoman for the airport. DHL, and its predecessor, Airborne Express, were at times the airport’s largest cargo carrier, she said.

From a peak of 45 million pounds in 2006, the cargo numbers fell to 30.4 million in 2008, before DHL pulled out in February 2009. Cargo weight has since grown steadily, from a low of 21 million in 2009, to 27 million in 2014, according to airport statistics.

Air cargo is a vital component of the service strategy, Goldstein said.

“We move ‘people and goods,’ ” she said in a statement. “As such, we want to afford our local and regional businesses as many logistical tools and options [as possible] as they compete in the ‘just in time’ global economy.”

The health of the airport is tied directly to the Rhode Island economy, and to that of its host city, Warwick.

The city receives, annually, payments from the airport in lieu of taxes, according to Mayor Scott Avedisian. Payments last year amounted to nearly $2 million, in direct appropriations, and to reimburse the city for fire and police services.

But Warwick also benefits from taxes collected from hotel meals and rooms, and its businesses from proximity to the transportation hub, he noted. Several businesses have located in Warwick, to take advantage of the airport.

“If they do well, we do well,” Avedesian said. “The more vibrant they are, the more vibrant we are.” •

I will answer the Headline question of “If you build it, will passengers come?” t

The answer is “NO!”. Any seasoned airport executive knows that.

In fact, the more debt TF Green and RIAC takes on, the more expensive it will be for postential passengers to fly from Rhode Island. Given that airports compete on a regional basis, the formula that RI politicians have for “expanding” TF Green, is having the reverse effect of what was intended, going from a small Low Cost Carrier airport to a high ticket priced airport, With increased ticket prices and costs to access Rhode Island’s airport, they are driving potential passenger away from TF Green to Boston’s Logan International Airport as well as Bradley Field in Connecticut, I wrote about this in my comments during the National Environmental Policy Act (NEPA) FEIS by questioning the validity of the FAA and RIAC’s stated “Purpose and Need” to fly non stop to the west coast (based on aircraft formerly in the SW Airlines fleet which have now been replaced by Boeing’s Next Generation Aircraft that have a higher coeficcient of lift and can do the mission from the existing runway).. The Final EIS also states that even if Logan becomes capacity constrained in the future, TF Green will not have a capacity problem with its current airport layout plan (ALP). In my comments, I also made people aware that the proposed runway extension does not make economic sense, The Purpose and Need identified by RIAC as the sponsor and the FAA is already met with the current safety improvment programs, The proof is that there are no capacity problems at TF Green, there will not be capacity problems if BOS Logan becomes capacity constrained, and the marginal increase in revenues are more than negatively offset by related costs of enviromnetal mitigation required by law, home and land acquisition costs, road relocation costs, and loss of tax revenuew to the City of Warwick, This is so true, that the FAA, after issuing it’s Record of Decision to extend the main runway, issued a recall of the Record of Desicion, and issued a Re-Evaluation, stating the the orignal plans are :”not financially feasible”, cutting the dollarized improvement program scope in half, from over $500mm to approximately $250mm.. It’s not like politicians, statewide planning, and staff were not aware of this., In October 2007, the NE Region FAA Airports Division Manager, issued a warning letter to RIAC calling their attention to key economic indicators, that if taken into account, would result in passenger traffic at TF Green falling, that RIAC had ignored those factors, and had failed to complete the required “financial plan”. (Yes its now another RI quagmire) I had also warned those involved in planning at the state level when invited to comment, specifically commenting that the passenger projections for TF Green were not sustainable. One key factor is that the previous passenger “boom” attributed to SW Airlines as a Low Cost Carrier (LCC) was really caused by Massachusetts area travelers chosing to temporarily use TF Green to avoid travelling to Boston’s Logan International during the massive “Big Dig” program which reconstructed the Southeast Expressway from Route 128 to Downtown Boston and feeds the access roads to Boston’s Logan Airport from Southerastern Massachsuetts.and Rhode Ilsnad, That program also included constructing Boston’s Third Harbor Tunnel, and an easterlly extension of the Massachusetts Turnpike to be directly connected to the new tunnel under Boston Harbor, It was known at that time, that many of the passengers who chose to temporarily use TF Green Airport, would eventually return to using Boston’s Logan International Airport, eventually lowering passenger volumes at TF Green post Big dig completion. By RIAC and TF Green adding unnecessary debt and increasing its ratio of airport operating cost per passenger enplaned, the politically controlled TF Green Airport is becoming less and less competitive in its regional market, and seeing its potential passengers chose to drive the extra 30 to 60 minutes to save hundreds of dollars in travel costs. After all, isn’t it ticket cost, not runway length, that most rational passengers use to decide what airport to fly from? And more travelers are choosing Boston and Hartford over Providence,

Overbuild it and passengers will go away”

Michael Zarum