HERE. / COURTESY LENDER PROCESSING SERVICES" title="THE NATIONAL FORECLOSURE INVENTORY remains near all-time highs, with 4.12 percent of all active mortgages in the foreclosure pipeline, according to the May Mortgage Monitor report released Monday by Lender Processing Services. For a larger version of this chart, click HERE. / COURTESY LENDER PROCESSING SERVICES"/>

HERE. / COURTESY LENDER PROCESSING SERVICES" title="THE NATIONAL FORECLOSURE INVENTORY remains near all-time highs, with 4.12 percent of all active mortgages in the foreclosure pipeline, according to the May Mortgage Monitor report released Monday by Lender Processing Services. For a larger version of this chart, click HERE. / COURTESY LENDER PROCESSING SERVICES"/>JACKSONVILLE, Fla. – The national foreclosure inventory remains near all-time highs, with 4.12 percent of all active mortgages in the foreclosure pipeline, according to the May Mortgage Monitor report released Monday by Lender Processing Services.

The 4.12 percent of mortgages in the foreclosure pipeline is in addition to the 3.2 percent that are 90 days or more delinquent but have yet to begin the foreclosure process.

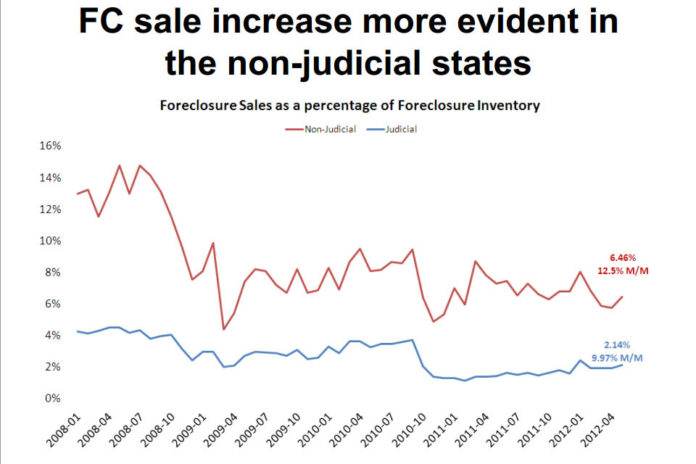

According to LPS applied analytics senior vice president Herb Blecher, the country’s foreclosure situation is more nuanced when looking at states that apply judicial versus non-judicial foreclosure processes.

“There’s a stark contrast in foreclosure inventories between judicial and non-judicial states,” Blecher said in prepared remarks, adding that in judicial states, 6.5 percent of all loans are in some stage of foreclosure, while in non-judicial states, only 2.5 percent of loans are in the foreclosure pipeline.

“Both these figures are significantly higher than the pre-crisis average of 0.5 percent, but it is worth noting that the average year-over-year decline in non-current loans for judicial states is less than 1 percent, whereas in non-judicial states, it’s down 7.1 percent,” said Blecher.

According to the LPS release, the difference between judicial and non-judicial states impact the length of time loans remain in the foreclosure pipeline. Roughly 53 percent of loans in foreclosure in judicial foreclosure states have been delinquent for more than two years, compared with just over 30 percent of loans in non-judicial states.

Nationally, foreclosure sales increased 10 percent in May, with the gain more pronounced in non-judicial states, 6.46 percent of the existing foreclosure inventory progressed to foreclosure sale in May compared with 2.14 percent in judicial states.

Rhode Island, a non-judicial foreclosure state, ranked 12th for the highest percentage of non-current loans in the U.S. at 12.4 percent. Year-over-year the Ocean State saw a 5.3 percent drop in the number of non-current loans.

According to the LPS report, the United States has a 7.2 percent loan delinquency rate.

Comparatively, 8.5 percent of Rhode Island mortgages were in delinquency.

Mississippi, the state with the highest percentage of loans in delinquency in the U.S., had a 13 percent rate and Alaska, the state with the lowest percentage of loans in delinquency, had a 1 percent rate.

For the full report visit: www.lpsvcs.com.